Our strategic partner Splendour Luxury Group offers premium relocation services.

- Now is the ideal time to invest in Portugal and take advantage of award winning services.

- A licensed Real estate brokerage, Lifestyle management and Design studio in Portugal. We guide you through the complete process offering a full range service. Finding you the best investments and being your interface in Portugal. Splendour Luxury Group was awarded the Best Luxury Real Estate Consultancy in Portugal for 2022 and 2023. This very credible and respected award is assurance that you selected the Best Luxury Real Estate Consultancy in Portugal to service you.

- 1. Immediate / Long Term Benefits

- 2. Investment Program

- 3. Tax benefits and Fees

- 4. Application process

- 5. Non-Golden Visa investors

1. Immediate / Long Term Benefits

Immediate Benefits

- Golden Visa issued in approximately 6 months once application is registered with Portuguese Immigration.

- Golden Visa holders have unlimited residence status within the 25 Schengen countries.

- Golden Visa holders must stay in Portugal only 35 days in a 5 year period.

Long Term benefits

- Golden Visa holders may apply for permanent resident status or citizenship after only 5 years.

- Golden Visa holders are granted the right to family regrouping; the main investor, spouse, children, parents of either spouse, and siblings can apply on the same application.

2. Investment Program

- Effective October 2023, the new Portugal Golden Visa legislation allows investing in private equity funds starting from €500,000 EUR.

- NOW is the time to capitalize on excellent investment value and generous family benefits!

- No travel to Portugal required until the Biometrics Identification appointment and the Portuguese Immigration & Borders Service (SEF) interview.

- Portugal property law states there are no restrictions or limitations for foreigners.

- Comprehensive legal services available through the global award winning International Law Firm headquartered in Lisbon Portugal for upcoming projects. Globally partnered law firms are strategically located to support Golden Visa investors and remote services are available .

3. Tax benefits and Fees

Non-Habitual Residents’ Tax Benefits

Once resident status is received through the Golden Visa program,

families may benefit from the Non Habitual Resident Tax regime.

- Benefit from a special personal income tax treatment for 10 years.

- Enjoying a tax exemption on almost all foreign source income.

- 20% flat rate for Portuguese source incomes from specific professions and income from self-employment, normal Portuguese income tax rates up to 48%.

- Become part of a white-listed tax environment within the European Union.

- No tax for gifts or inheritance to direct family members.

- No wealth tax.

- Free remittance of funds to Portugal

Golden Visa program fees

Foreign and Border Services Fees

- order reception and analysis € 533.90

- issue of residence permit € 5336.40

- renewal of residence permit € 2668.20

-

residence permit for family members € 5336.40 *

* when concerning minors the rate is reduced to 50%

- renewal of residence permit for family members € 2668.20

Portuguese Property Tax and Closing Fees

- stamp duty of only 0.8% is payable on real estate purchase simulation of € 500,000 = €4,000

- Annual local tax rates vary from 0.3% to 0.8% depending on property type, location and age. In Lourinhã tax rate is only 0.35%

- IMT Transfer Tax - for buyers with a residency status simulation for real estate purchase of € 500,000 = € 28,040.74.

- For buyers with no residency status for tax purposes simulation for real estate purchase of €500,000 = €28,964.65.

- Other costs: notary € 650 estimated and land registry fees €250.

- Other closing costs: lawyer or translator fees, mortgage and bank fees (if necessary) valuation and registration fees.

4. Application process

- Decide the investment

- Confirm the purchase agreement (collect minimum €500,000)

- Complete the application

- Book appointment with Immigration department

- Attend interview (only travel to Portugal for this Immigration interview)

- Issue Golden Visa in approximately 6 months (unlimited residence status within the 25 Schengen countries)

- Choose citizenship or permanent resident status in only 5 years.

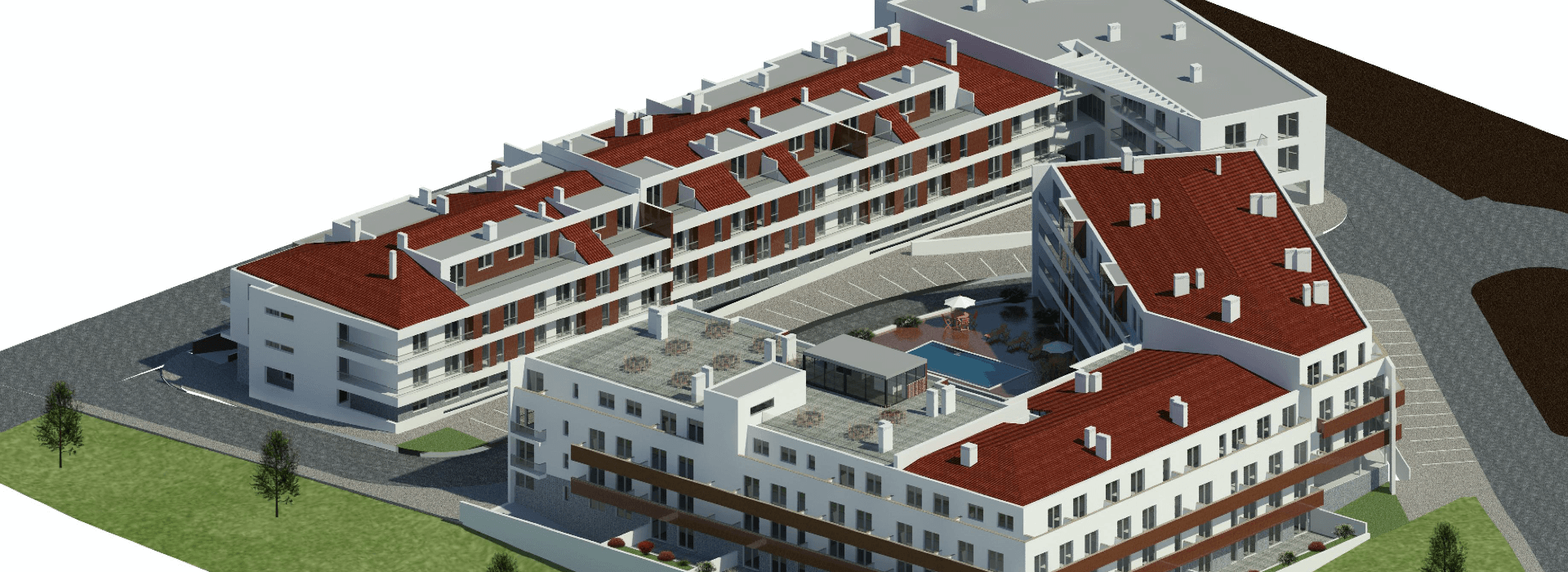

5. Non-Golden Visa investors

- Investors simply purchase the condominium model or commercial store unit of their choice.

- Investors will not receive the immediate benefits of the Golden Visa for unlimited residence status within the 25 Schengen countries (26 including Portugal).

- The IMT Transfer Tax on the investment purchase will be higher.